In today’s interconnected world, advancements in technology and fintech innovations have paved the way for UK entrepreneurs to expand their businesses globally with unprecedented ease. From streamlined communication tools to sophisticated financial technologies, the barriers to international business that once existed are rapidly disappearing.

Enhanced Communications: The World at Your Fingertips

One of the key drivers enabling global expansion is the revolution in communication technologies. Modern entrepreneurs are no longer confined by geographic or temporal boundaries. Video conferencing tools like Zoom and Microsoft Teams have made it possible to manage teams, pitch to clients, and oversee operations across different continents in real-time. Furthermore, cloud-based services such as Google Workspace and Microsoft 365 allow for seamless collaboration on documents and projects, ensuring that all team members are synchronised, no matter where they are physically located.

Financial Technology: Simplifying Global Transactions

Perhaps even more transformative has been the rise of financial technology, or fintech. UK entrepreneurs now have at their disposal a plethora of tools designed to facilitate efficient and secure financial transactions across borders. Fintech innovations not only speed up transactions but also significantly reduce costs and complexity associated with international money transfers and currency exchanges.

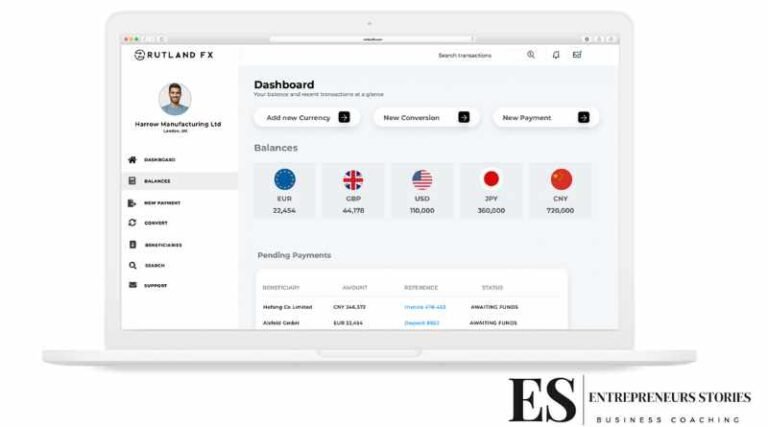

Companies like Rutland FX, a prominent player in the fintech space, offer specialised services that enable businesses to execute cross-border payments effortlessly. By providing more favourable exchange rates and lower fees compared to traditional banks, Rutland FX helps small and medium-sized enterprises (SMEs) expand their operations globally without the hefty financial burden typically associated with such endeavours. Additionally, Rutland FX offers multi-currency accounts, making it easier for businesses to get paid in various currencies and manage balances in multiple currencies, further simplifying the process of international trade.

E-commerce and Digital Marketplaces

The rise of e-commerce platforms and digital marketplaces has also played a crucial role in facilitating international business. Platforms like Amazon, eBay, and Shopify allow entrepreneurs to sell their products worldwide. These platforms not only provide the infrastructure needed for global commerce but also handle many of the logistical challenges, including international shipping and customs clearance.

Regulatory Technology (RegTech)

Navigating the complex web of international laws and regulations can be daunting for businesses looking to expand abroad. This is where Regulatory Technology, or RegTech, comes in. RegTech solutions help businesses comply with international laws and regulations efficiently and cost-effectively. This not only minimises the risk of non-compliance but also saves valuable time and resources that can be better spent on core business activities.

Conclusion

The landscape of global business has been transformed by advancements in technology, communications, and fintech. UK entrepreneurs are now better equipped than ever to explore new markets and seize opportunities beyond their borders. With the help of innovative companies like Rutland FX and the power of digital tools, the dream of running a global business is now more attainable than ever. As we look to the future, it is clear that the trend towards globalization will only continue to grow, bringing more opportunities for ambitious businesses ready to take on the world.